Estimating the financial standing of a person can be complex and often lacks complete transparency. How can one understand the significance of such figures?

The financial resources of an individual, often referred to as their net worth, represent the total value of their assets, including investments, property, and other holdings, minus any outstanding debts. This figure reflects a snapshot of their accumulated wealth at a specific point in time. Precise valuations are not always publicly available and are subject to changes based on market fluctuations and personal transactions. Determining the exact net worth of any individual can be a challenge, often contingent on publicly available information.

Understanding an individual's financial status can be insightful for various reasons. It may offer a context for judging an individual's success, influence, and potential impact. In the business world, it can help evaluate investment opportunities or gauge the stability of a company. Furthermore, public knowledge of an individual's financial standing may inform discussions and decisions related to public policy, philanthropic endeavors, and business activities.

| Category | Data |

|---|---|

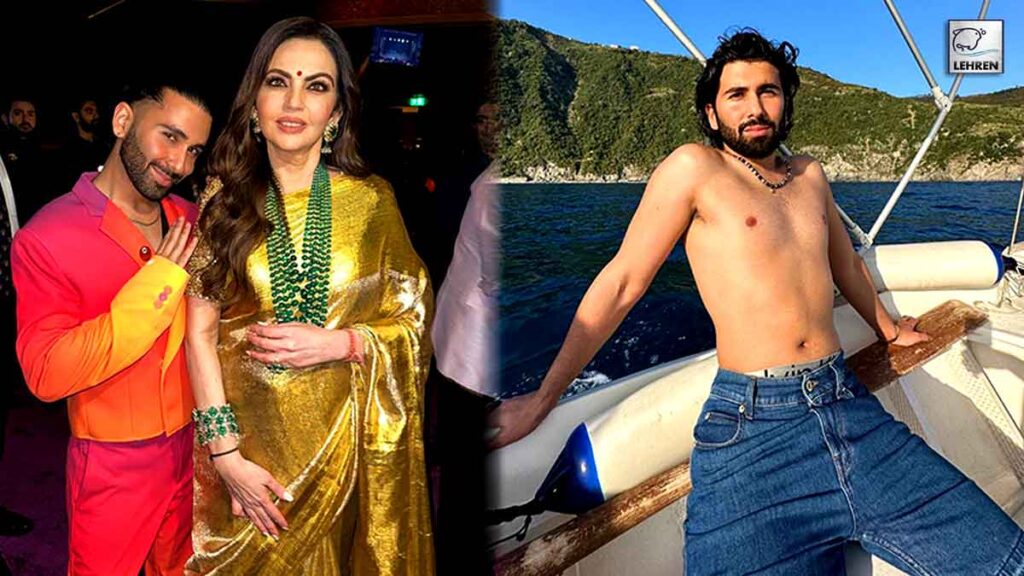

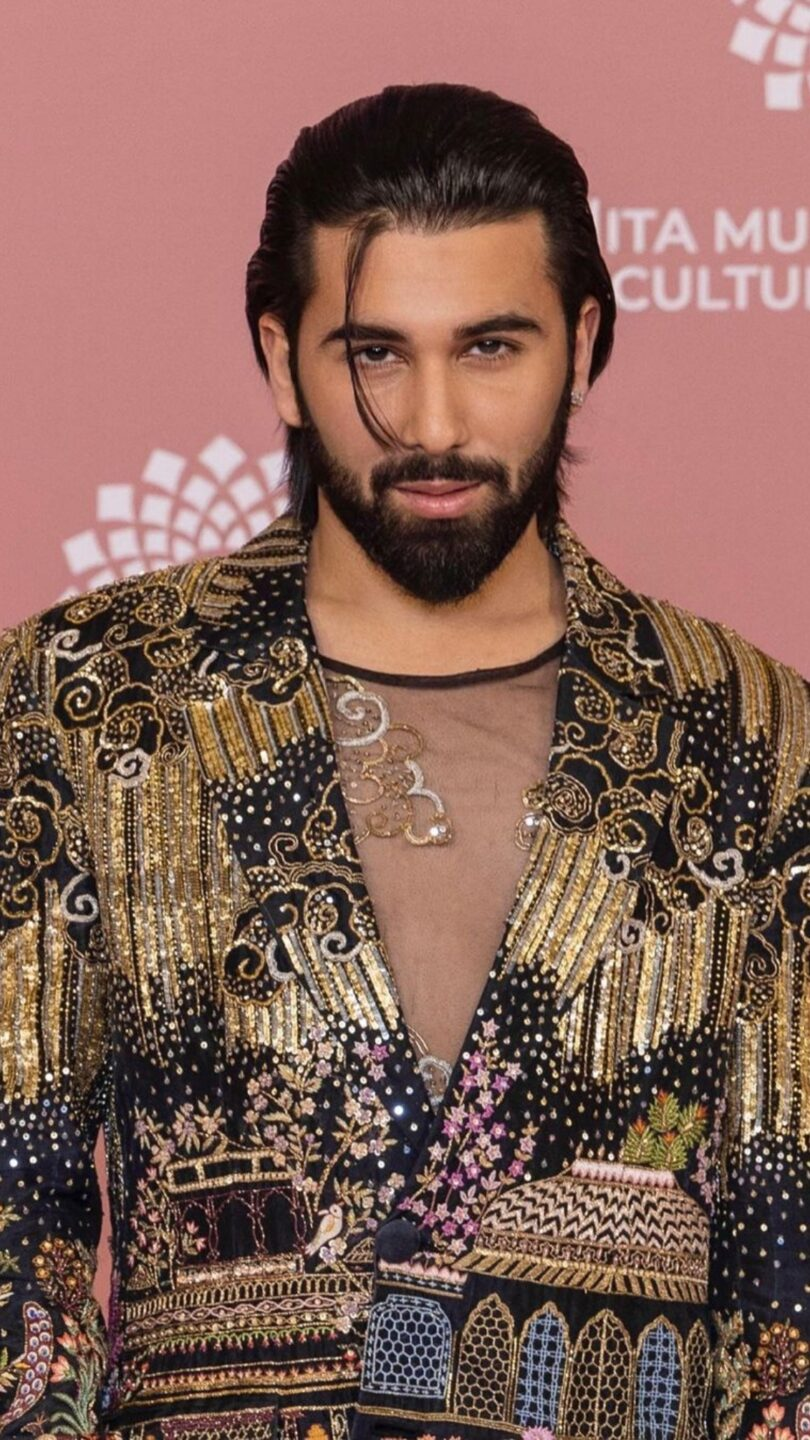

| Name | Orry Awatramani |

| Profession | (To be filled in) |

| Known for | (To be filled in) |

| Publicly Available Information | (To be filled in e.g., limited information, none, etc.) |

The subsequent sections will explore various facets of individual wealth, its implications, and the limitations inherent in estimating it accurately.

Orry Awatramani Net Worth

Evaluating Orry Awatramani's financial standing provides insight into accumulated wealth and its potential implications. Understanding the key aspects of this individual's financial status is essential for comprehensive analysis.

- Assets

- Income

- Investments

- Debts

- Valuation

- Transparency

The key aspectsassets, income, investments, and debtscollectively determine net worth. Accurate valuation requires considering various factors. Transparency in financial reporting allows for external scrutiny. For instance, a high income stream coupled with substantial investments and minimal debts might suggest a substantial net worth. Conversely, significant debts may negate the value of assets, indicating a different financial standing. Ultimately, the interconnectedness of these elements creates a comprehensive view of financial strength.

1. Assets

Assets, in the context of net worth, represent resources owned by an individual. These resources, including tangible items like real estate, vehicles, and personal possessions, alongside intangible assets such as intellectual property, investments, and other financial holdings, contribute directly to a person's total net worth. The value of these assets plays a crucial role in calculating net worth. Fluctuations in asset values directly impact the overall financial standing. For example, an increase in the market value of stocks held as an investment will reflect a higher net worth, while a decline in property values will have the opposite effect.

The importance of understanding assets in the context of net worth is multifaceted. Accurate assessment of assets is fundamental to understanding an individual's financial position. This understanding is vital for evaluating potential investment opportunities, assessing risk tolerance, and managing financial resources effectively. For instance, an individual with significant real estate holdings will likely have a substantial net worth compared to someone with limited assets. The presence, type, and value of assets provide a comprehensive picture of an individual's accumulated wealth. Furthermore, the diversification of assets, as well as their liquidity, can affect the stability and resilience of an individual's overall financial status.

In summary, assets are a cornerstone of net worth. Their value, type, and diversification all contribute to the overall financial picture. Understanding the relationship between assets and net worth is crucial for comprehending an individual's financial standing and making informed financial decisions.

2. Income

Income directly influences an individual's net worth. Consistent and substantial income provides resources to accumulate assets, reduce debts, and ultimately enhance net worth. Conversely, insufficient or erratic income limits an individual's capacity to build wealth. This relationship is fundamental and observable across various financial situations. For example, a high-income professional with prudent financial habits is more likely to achieve a higher net worth compared to someone with a lower income and/or high expenses.

The importance of income in determining net worth is evident in its direct contribution to savings and investment. Higher income facilitates the ability to save a larger portion of earnings, allowing for investments in assets like stocks, bonds, real estate, or other ventures. This investment potential, in turn, contributes significantly to the growth of net worth over time. Conversely, individuals with limited income may find it challenging to allocate funds towards saving or investing, potentially leading to a slower or stagnant increase in net worth. Real-world examples illustrate this: entrepreneurs in high-growth industries often accumulate substantial net worth through successful income generation; while individuals in lower-paying professions may require significant time and effort to achieve similar results.

In conclusion, income acts as a critical driver in the accumulation of wealth and subsequent determination of net worth. The relationship between income and net worth is demonstrably strong, highlighting the importance of consistent and sufficient income for sustainable wealth building. However, income is just one componentprudent financial decisions, investment strategies, and responsible debt management are all equally vital in achieving and maintaining a healthy net worth.

3. Investments

Investments play a crucial role in determining net worth. The nature and performance of investments directly impact the overall financial standing of an individual. Successful investment strategies can significantly enhance net worth over time, while poorly managed investments can have the opposite effect.

- Types of Investments

Investment strategies encompass a wide range, each with its own degree of risk and potential return. Stocks, bonds, real estate, and other ventures represent potential avenues for wealth accumulation. The type and diversification of investments held directly influence the total value of assets and, consequently, net worth. The optimal investment portfolio depends on numerous factors, including risk tolerance, financial goals, and time horizon.

- Investment Returns and Growth

The performance of investments is a critical factor in net worth growth. Positive returns from investments generate capital gains, increasing the value of assets within a portfolio. Sustained, substantial returns over an extended period can substantially augment net worth. Conversely, losses on investments reduce the overall net worth. The rate of return and the growth potential of investments are significant considerations in financial planning. Examples illustrating this connection are readily available from successful venture capitalists and experienced investors.

- Risk Tolerance and Diversification

An individual's risk tolerance plays a significant role in the selection and management of investments. Higher-risk investments typically offer the potential for greater returns, but carry a greater chance of losses. Diversification, or distributing investment across various asset classes, is crucial for mitigating risk and potentially maximizing returns. A diverse portfolio is generally more resilient to market fluctuations, a factor directly affecting net worth. Investment choices should align with personal risk tolerance.

- Impact on Net Worth

The magnitude and trajectory of investment returns profoundly affect the evolution of net worth. Successful investment strategies result in capital gains, leading to increased net worth. Conversely, poor investment choices or market downturns can erode net worth. The long-term success of investments and their influence on net worth are contingent upon careful research, diversified portfolio strategies, and prudent risk assessment.

Understanding the connection between investments and net worth underscores the critical role of careful planning, effective diversification, and risk management. These factors, when implemented thoughtfully, contribute to the growth and preservation of accumulated wealth. Successful management of investments is crucial for long-term financial security and reflects a significant aspect of an individual's overall financial profile.

4. Debts

Debts represent outstanding financial obligations. In calculating net worth, debts are subtracted from total assets. This subtraction directly impacts the final net worth figure. Higher levels of debt reduce net worth, while a decrease in debt improves it. A significant understanding of debt is essential for determining and analyzing an individual's overall financial health. The relationship between debts and net worth is fundamental and directly observable in financial statements.

The impact of debts on net worth is substantial. High levels of debt can significantly reduce the value of net worth, potentially resulting in a negative net worth if debts exceed assets. This situation can create financial instability and hinder future opportunities. Conversely, a reduction in debt levels directly improves the net worth calculation. Responsible debt management, including timely repayments and avoiding excessive borrowing, is crucial for maintaining a positive and healthy net worth. For example, an individual with substantial mortgage payments, student loans, or credit card debt will likely have a lower net worth compared to someone with minimal or no outstanding debt. This difference is a direct result of the subtraction of debt from total assets.

Understanding the connection between debts and net worth is crucial for informed financial decision-making. Recognizing the detrimental impact of high debt levels empowers individuals to adopt strategies for debt reduction and responsible borrowing. A clear understanding of this relationship is essential for evaluating an individual's overall financial position and making proactive choices to achieve financial stability and a higher net worth over time. This awareness is fundamental to sound personal finance, impacting everything from investment decisions to the potential for future economic growth and security.

5. Valuation

Determining Orry Awatramani's net worth hinges on accurate valuation. This process involves assessing the worth of assets and subtracting liabilities. The accuracy of this assessment is critical, as fluctuations in asset values or changes in liabilities can significantly alter the calculated net worth. Understanding valuation methodologies is essential for interpreting and analyzing financial information associated with an individual's wealth.

- Asset Valuation Methods

Different asset classes require specific valuation techniques. Real estate valuations might employ comparable sales analysis or discounted cash flow models. Stocks and other securities are often valued based on market prices. The chosen methodology significantly impacts the estimated value of the asset, and consequently, the overall net worth. Variations in valuation techniques between professionals or organizations can produce differing assessments.

- Market Fluctuations and Valuation

Market conditions play a significant role in asset valuations. The value of publicly traded stocks, for example, is directly tied to market fluctuations. Similar correlations exist for real estate and other investment assets. These fluctuations influence the perceived value of holdings, thus affecting the net worth calculation. Predicting future market behavior and its impact on asset values is a complex challenge for financial analysts.

- External Influences on Valuation

Various external factors can affect the valuation process. Economic conditions, regulatory changes, and industry trends influence asset values and, subsequently, calculated net worth. For instance, an economic downturn might depress the value of certain investments. Similarly, changes in tax laws or industry-specific regulations might affect valuations of specific assets. Recognizing these external influences is crucial to understanding the dynamic nature of wealth assessments.

- Transparency and Valuation

Transparency in the valuation process is essential for establishing confidence in the reported net worth. Clear documentation of methodologies and assumptions used for asset appraisals ensures objectivity. Publicly available information, where available, helps validate the calculations. Different valuation approaches can lead to variations in the estimated net worth. Lack of transparency can hinder objective analysis and understanding.

In summary, the valuation process is crucial for accurately reflecting Orry Awatramani's net worth. Understanding the various methods, the impact of market fluctuations, and external factors affecting asset values, along with the importance of transparency, are vital to interpreting and analyzing any reported financial figures and to forming well-informed judgments about the individual's overall financial position.

6. Transparency

The concept of transparency is crucial when discussing an individual's net worth, particularly one as potentially complex as Orry Awatramani's. Transparency, in this context, refers to the clarity and openness in disclosing financial information. Without transparency, accurate assessment of net worth becomes significantly more challenging. Publicly available financial disclosures allow for independent verification and informed analysis, fostering trust and understanding surrounding the reported financial standing. The absence of transparency can lead to speculation, misinterpretation, and ultimately, a less accurate portrayal of the individual's financial status. Publicly available financial records, when available, offer a benchmark for assessing the validity of claims about net worth.

The importance of transparency in assessing net worth is evident in its impact on public perception. Clear financial disclosures build trust and credibility, essential elements in establishing confidence in a person's financial management and overall standing. Conversely, a lack of transparency can create suspicion and doubt, potentially hindering opportunities for investment, partnerships, or other collaborations. For example, companies with transparent financial reporting attract investors more readily compared to those with opaque practices, showcasing a direct link between disclosure and perceived stability and trust. Likewise, individuals and organizations with consistent, demonstrably transparent financial dealings are generally viewed more favorably and command greater respect, both professionally and personally.

In conclusion, transparency is a critical component in understanding net worth. Its absence can lead to ambiguity and skepticism, while its presence fosters trust, credibility, and accurate assessment of a person's financial position. For Orry Awatramani, or any individual, transparency in financial dealings facilitates informed judgments and strengthens the integrity of the associated financial narrative.

Frequently Asked Questions about Orry Awatramani's Net Worth

This section addresses common inquiries regarding the financial status of Orry Awatramani. Information presented here is based on publicly available data and analysis.

Question 1: What is net worth, and how is it determined?

Net worth represents the difference between an individual's assets (total value of possessions) and liabilities (outstanding debts). It reflects an individual's accumulated wealth at a specific point in time. Accurate determination requires precise valuation of assets and liabilities, potentially employing various methodologies depending on the nature of the assets involved. Market fluctuations, changes in investment values, and other factors can affect the net worth calculation.

Question 2: Why is it difficult to ascertain a precise net worth for individuals like Orry Awatramani?

Publicly available financial information for individuals is often limited. Detailed financial records may not be consistently accessible, particularly for private figures. Complex investment portfolios, private holdings, and other aspects of financial status contribute to the challenge of accurately determining an exact net worth.

Question 3: How do investments influence net worth?

Investments significantly impact net worth. Positive returns on investments add to the value of an individual's assets, leading to a higher net worth. Conversely, losses decrease net worth. The type and diversification of investments, along with their performance, are crucial factors in the growth or decline of accumulated wealth. Different investment strategies and market conditions yield varying results.

Question 4: What is the significance of debt in relation to net worth?

Debt represents outstanding financial obligations. The presence of substantial debt reduces net worth, as liabilities are subtracted from assets. Effective debt management and responsible borrowing practices are important factors in achieving and maintaining a positive net worth. The types and amounts of debt can vary considerably, affecting the net worth calculation differently.

Question 5: How do external factors impact net worth estimations?

External economic conditions, market fluctuations, and legislative changes can influence the value of assets and liabilities. These factors can impact the precision of net worth calculations. Accurate estimations require considering the potential influence of these broader economic conditions on the individual's financial status.

The information provided here aims to clarify common inquiries related to net worth. It is crucial to remember that precise financial figures often remain confidential and subject to variations.

Moving forward, the next section will delve into the role of public perception in shaping understanding of individuals' financial status.

Conclusion

Assessing Orry Awatramani's net worth necessitates a comprehensive understanding of financial principles. The calculation hinges on accurately valuing assets, considering liabilities, and acknowledging the dynamic nature of financial markets. Fluctuations in market conditions, investment performance, and the variety of assets held all contribute to the complexities of such estimations. Publicly available information, while valuable, often proves insufficient for a definitive evaluation. Consequently, precise determination of net worth frequently remains elusive. This inherent difficulty underscores the importance of accurate financial reporting when such information is publicly available, enabling informed judgment. Furthermore, the influence of income, investments, debts, and the valuation methodologies themselves highlights the interplay of various factors in shaping financial status.

The exploration of Orry Awatramani's net worth, or any individual's financial standing, serves as a reminder of the intricate interplay of economic forces and personal choices. The process underscores the importance of meticulous financial management and highlights the dynamic nature of wealth accumulation. Understanding these principles is pivotal for both individuals seeking to improve their financial well-being and for those evaluating financial data in a wider context. Careful consideration of various methodologies and the limitations of readily available data remain crucial for a meaningful evaluation. Further research, particularly if further information emerges, may illuminate a more complete picture.