What happens when you deposit a check twice?

Depositing a check twice is the act of depositing the same check into your bank account more than once. This can happen accidentally or intentionally, and the consequences can vary depending on the bank's policies and the specific circumstances.

In general, depositing a check twice is not advisable. If you accidentally deposit a check twice, you should contact your bank immediately to have the duplicate deposit reversed. If you intentionally deposit a check twice, you may be committing fraud, which is a crime.

Here are some of the potential consequences of depositing a check twice:

- The bank may reverse the duplicate deposit, which could result in overdraft fees or other penalties.

- The bank may close your account.

- You may be charged with fraud.

If you have any questions about depositing a check, you should contact your bank for more information.

Deposited a Check Twice

Depositing a check twice refers to the act of depositing the same check into a bank account more than once. This action can be done intentionally or accidentally, and the repercussions can vary depending on the bank's policies and the specific circumstances.

- Unintentional error

- Fraudulent intent

- Bank policy violation

- Overdraft fees

- Account closure

- Criminal charges

- Reversal of duplicate deposit

- Impact on credit history

Depositing a check twice can have serious consequences, including overdraft fees, account closure, and even criminal charges. If you accidentally deposit a check twice, you should contact your bank immediately to have the duplicate deposit reversed. If you intentionally deposit a check twice, you are committing fraud and could face legal penalties.

1. Unintentional error

An unintentional error in the context of depositing a check twice can occur due to various reasons, primarily stemming from oversight or human mistake. These errors can arise from factors such as:

- Lack of attention: Failing to verify the check's status before re-depositing it, resulting in the same check being processed multiple times.

- System malfunction: Technical glitches or errors within the banking system can lead to duplicate deposits being processed, even if the customer intended to deposit the check only once.

- Human error: Mistakes made by bank tellers or other bank employees during the deposit process, such as accidentally scanning the same check twice.

- Misunderstanding: Confusion or lack of clarity regarding the check's status, leading the customer to believe that the initial deposit was unsuccessful and therefore re-depositing the check.

It is crucial to address unintentional errors promptly to minimize any potential negative consequences. Customers should carefully review their bank statements and promptly report any duplicate deposits to their bank. Banks typically have policies and procedures in place to handle such errors and reverse duplicate deposits, helping to mitigate any financial or legal implications for the customer.

2. Fraudulent intent

When a check is deposited twice with fraudulent intent, the perpetrator aims to deceive the bank and illicitly obtain funds. This malicious act involves intentionally depositing the same check multiple times to exploit a loophole or banking error.

- Double-deposit scheme

In this scheme, the fraudster deposits a check into their account and withdraws the funds immediately. They then re-deposit the same check into a different account, often using a different bank or branch, to create the illusion of having two separate deposits. The perpetrator then withdraws the funds from the second account, resulting in double the intended amount.

- Check kiting

Check kiting is a more sophisticated form of check fraud that involves writing checks from multiple accounts with insufficient funds. The fraudster deposits a check from one account into another and uses the funds to cover the overdraft created by the first check. This process is repeated several times, creating a cycle of bounced checks and inflated account balances.

- Counterfeit checks

Counterfeit checks are forged checks that appear genuine but are created with fraudulent intent. Perpetrators may steal or purchase blank checks and alter them to resemble legitimate checks. They then deposit these counterfeit checks into their accounts and withdraw the funds before the bank detects the forgery.

- Altered checks

Altering checks involves changing the amount, payee, or other details on a genuine check to increase its value or redirect the funds to the perpetrator's account. Fraudsters may use chemical solutions or digital editing software to manipulate the check and deceive the bank.

Fraudulent intent in the context of depositing a check twice is a serious crime that can result in severe consequences, including criminal charges, fines, and imprisonment. Banks have implemented various security measures and fraud detection systems to combat these malicious activities and protect the integrity of the financial system.

3. Bank policy violation

When depositing a check twice, one may be in violation of bank policy. Banks establish rules and guidelines to maintain the integrity of their financial transactions and protect their customers' funds. Violating these policies can result in various consequences, from declined deposits to account closures.

- Unauthorized deposits

Banks typically have policies that prohibit customers from depositing checks that do not belong to them or that have been altered in any way. Depositing a check without authorization or making changes to the check's information can be considered a violation of bank policy.

- Duplicate deposits

As discussed earlier, depositing the same check twice, whether intentionally or unintentionally, is a violation of bank policy. Banks have systems in place to detect and prevent duplicate deposits, and attempting to deposit a check twice may result in the reversal of the duplicate deposit or other penalties.

- Insufficient funds

Depositing a check against an account that does not have sufficient funds to cover the check amount can be a violation of bank policy. Banks may charge overdraft fees or return the check unpaid, which can lead to additional fees and damage to the customer's credit history.

- Suspicious activity

Banks monitor their customers' transactions for any suspicious activity, including frequent deposits of large checks or deposits that appear to be structured to avoid detection. Depositing a check twice may raise red flags and trigger an investigation by the bank's fraud department.

Violating bank policy when depositing a check twice can have serious consequences, including frozen accounts, declined transactions, and damage to the customer's reputation. It is important to be aware of and adhere to bank policies when conducting financial transactions to avoid any potential issues.

4. Overdraft fees

Overdraft fees are charges imposed by banks when a customer's account balance falls below zero due to a transaction, such as a check or debit card purchase, that exceeds the available balance. Depositing a check twice can lead to overdraft fees if the bank processes the duplicate deposit before the original check clears.

- Insufficient funds: When a duplicate deposit is processed, the bank may assume that the customer has sufficient funds to cover both deposits. However, if the original check has not yet cleared, the account may not have enough funds to cover the second deposit. This can result in an overdraft and associated fees.

- Delayed processing: In some cases, banks may take several days to process checks. If a customer deposits a check twice and the duplicate deposit is processed before the original check, it can lead to an overdraft even if the customer had sufficient funds in their account at the time of the first deposit.

- Bank policy: Some banks have policies that specifically prohibit depositing the same check twice. Attempting to do so may result in the reversal of the duplicate deposit and/or the imposition of overdraft fees.

- Unintentional errors: Unintentional errors, such as accidentally depositing the same check twice, can also lead to overdraft fees. Customers should carefully review their bank statements and promptly report any duplicate deposits to avoid unnecessary fees.

To avoid overdraft fees related to depositing a check twice, customers should be mindful of the following tips:

- Verify the check's status: Before depositing a check, customers should verify that it has not already been deposited. This can be done by checking their bank statement or online banking account.

- Deposit the check only once: Once a check has been deposited, customers should not attempt to deposit it again, even if they believe the first deposit was unsuccessful.

- Contact the bank immediately: If a customer accidentally deposits a check twice, they should contact their bank immediately to report the error. The bank may be able to reverse the duplicate deposit and avoid overdraft fees.

5. Account closure

Account closure refers to the termination of a bank account by the financial institution. This action can be initiated by the bank or the account holder for various reasons, one of which is depositing a check twice.

When a customer deposits a check twice, it violates the bank's policies and can lead to a number of consequences, including account closure. Banks have strict policies in place to prevent fraud and protect the integrity of their financial system. Depositing the same check twice is considered a breach of these policies and can be viewed as an attempt to deceive the bank.

In cases where a customer intentionally deposits a check twice to obtain funds fraudulently, the bank may close the account and report the incident to the authorities. This can have serious consequences for the customer, including criminal charges and damage to their credit history.

Even in cases where the duplicate deposit is made unintentionally, the bank may still close the account if it believes that the customer has violated their policies or engaged in suspicious activity. Banks are required to monitor their customers' transactions for any signs of fraud or suspicious activity, and depositing a check twice may raise red flags that trigger an investigation.

To avoid account closure, customers should be mindful of the following:

- Verify the check's status: Before depositing a check, customers should verify that it has not already been deposited. This can be done by checking their bank statement or online banking account.

- Deposit the check only once: Once a check has been deposited, customers should not attempt to deposit it again, even if they believe the first deposit was unsuccessful.

- Contact the bank immediately: If a customer accidentally deposits a check twice, they should contact their bank immediately to report the error. The bank may be able to reverse the duplicate deposit and avoid account closure.

By following these guidelines, customers can help to protect their bank accounts and avoid the risk of account closure.

6. Criminal charges

Depositing a check twice can be a serious offense, and in some cases, it can lead to criminal charges. This is because depositing a check twice is considered a form of fraud, which is a crime. Fraud is the intentional deception of another person or entity for personal gain. When someone deposits a check twice, they are essentially trying to trick the bank into giving them money that they are not entitled to.

- Bank fraud

Bank fraud is a federal crime that can be charged when someone knowingly and willfully defrauds a bank. Depositing a check twice can be considered bank fraud if the person who deposits the check knows that the check has already been deposited or if they know that the check is not valid.

- Forgery

Forgery is another federal crime that can be charged when someone alters or counterfeits a check. Depositing a check twice can be considered forgery if the person who deposits the check has altered the check in some way, such as by changing the amount of the check or the payee.

- Money laundering

Money laundering is a federal crime that can be charged when someone knowingly and willfully transports, transmits, or conceals money that has been obtained through illegal activity. Depositing a check twice can be considered money laundering if the person who deposits the check knows that the check was obtained through illegal activity, such as fraud or theft.

- Embezzlement

Embezzlement is a state crime that can be charged when someone who has been entrusted with money or property steals that money or property. Depositing a check twice can be considered embezzlement if the person who deposits the check has been entrusted with the check and then steals the money from the check.

The penalties for criminal charges related to depositing a check twice can vary depending on the specific charges that are filed and the jurisdiction in which the charges are filed. However, these penalties can include fines, imprisonment, and a criminal record.

7. Reversal of duplicate deposit

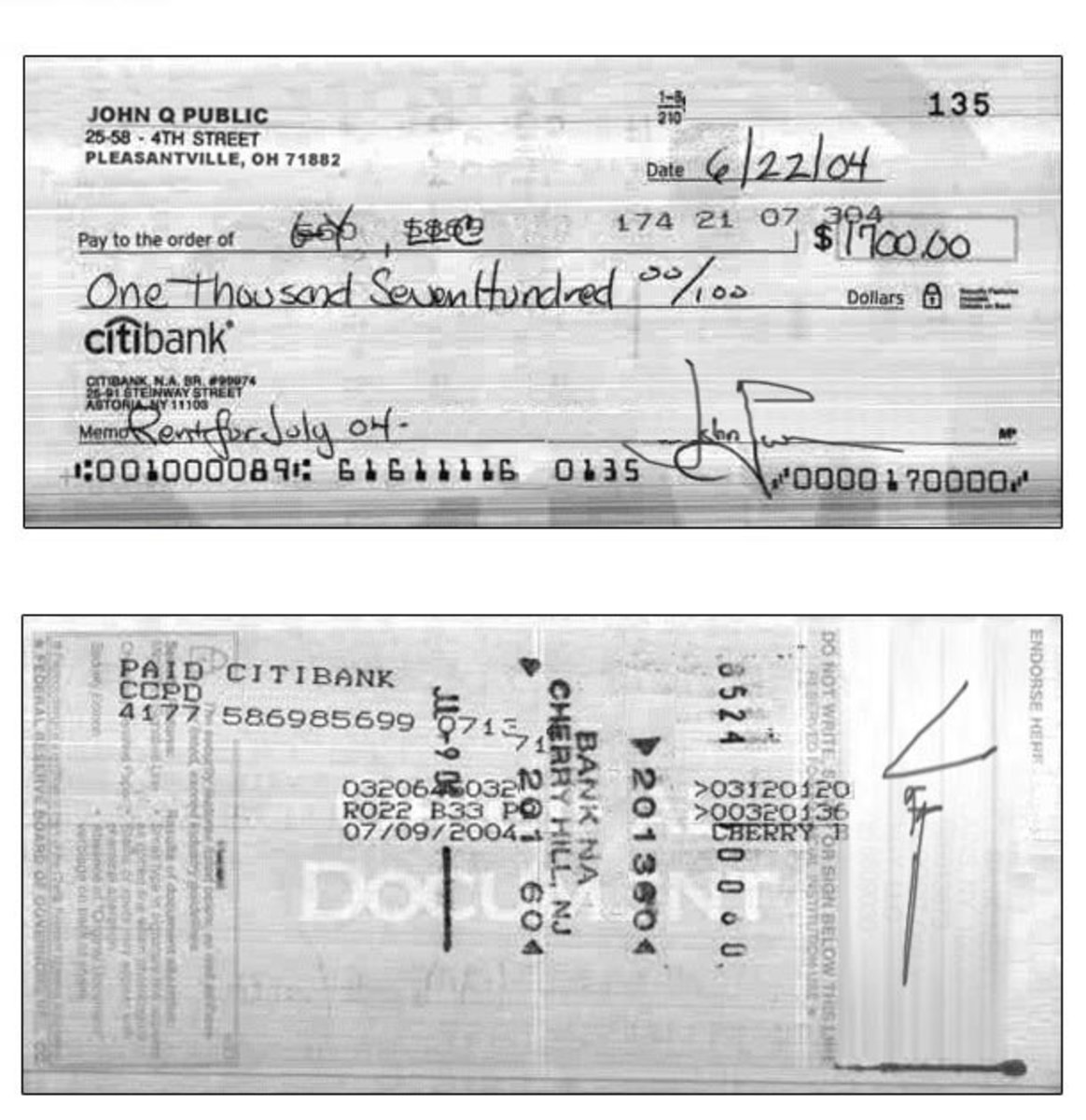

A duplicate deposit occurs when the same check is deposited into a bank account more than once. This can happen accidentally or intentionally. When a duplicate deposit is identified, the bank will typically reverse the duplicate deposit, which means that the funds from the duplicate deposit will be removed from the account.

The reversal of a duplicate deposit is important because it helps to prevent fraud and protect the integrity of the banking system. If duplicate deposits were not reversed, it would be possible for people to deposit the same check multiple times and receive multiple payments for the same check. This could lead to significant financial losses for banks and could also be used to launder money.

There are a number of ways to prevent duplicate deposits from occurring. One way is to use a check scanner that can identify duplicate checks. Another way is to use a positive pay system, which requires businesses to verify the authenticity of checks before they are deposited.

If you accidentally deposit a check twice, you should contact your bank immediately. The bank will be able to reverse the duplicate deposit and ensure that you do not receive multiple payments for the same check.

8. Impact on credit history

Depositing a check twice can have a negative impact on your credit history. When you deposit a check, the bank places a hold on the funds until the check clears. If you deposit the same check twice, the bank may assume that you are trying to defraud them. This can lead to the bank closing your account and reporting the incident to the credit bureaus.

FAQs on Depositing a Check Twice

Depositing a check twice can have serious consequences, including bank fees, account closure, and even criminal charges. Here are some frequently asked questions about depositing a check twice:

Question 1: What happens if I accidentally deposit a check twice?

If you accidentally deposit a check twice, you should contact your bank immediately. The bank may be able to reverse the duplicate deposit and avoid any penalties.

Question 2: What are the penalties for depositing a check twice intentionally?

The penalties for depositing a check twice intentionally can vary depending on the specific charges that are filed and the jurisdiction in which the charges are filed. However, these penalties can include fines, imprisonment, and a criminal record.

Question 3: Can depositing a check twice affect my credit history?

Yes, depositing a check twice can have a negative impact on your credit history. When you deposit a check, the bank places a hold on the funds until the check clears. If you deposit the same check twice, the bank may assume that you are trying to defraud them. This can lead to the bank closing your account and reporting the incident to the credit bureaus.

Question 4: What should I do if I think I have been a victim of check fraud?

If you think you have been a victim of check fraud, you should contact your bank immediately. The bank can help you to file a fraud claim and may be able to recover your funds.

Question 5: How can I avoid depositing a check twice?

There are a few things you can do to avoid depositing a check twice:

- Keep a record of all the checks you deposit.

- Compare your bank statement to your check register to make sure that all of the checks you deposited have cleared.

- Use a check scanner to identify duplicate checks.

- Use a positive pay system, which requires businesses to verify the authenticity of checks before they are deposited.

Summary

Depositing a check twice is a serious offense that can have a number of negative consequences. If you accidentally deposit a check twice, you should contact your bank immediately. If you intentionally deposit a check twice, you could be charged with a crime.

Transition to the next article section

To learn more about check fraud, please visit the Federal Trade Commission's website at https://www.consumer.ftc.gov/articles/how-recognize-and-avoid-check-fraud.

Conclusion on Depositing a Check Twice

Depositing a check twice is a serious offense that can have a number of negative consequences, including bank fees, account closure, and even criminal charges. It is important to be aware of the risks associated with depositing a check twice and to take steps to avoid doing so.

If you accidentally deposit a check twice, you should contact your bank immediately. The bank may be able to reverse the duplicate deposit and avoid any penalties. However, if you intentionally deposit a check twice, you could be charged with a crime.

To avoid the negative consequences of depositing a check twice, you should keep a record of all the checks you deposit, compare your bank statement to your check register to make sure that all of the checks you deposited have cleared, and use a check scanner to identify duplicate checks.

- The Rocks Wrestling Career From Wwe To Hollywood Superstar

- Top Pompeo Actresses Stars In Shows Movies