What is a Deposited Check?

A deposited check is a check that has been placed into a bank account. This can be done in person at a bank branch, through an ATM, or by using a mobile banking app. Once a check is deposited, the funds from the check will be added to the account balance.

Importance and Benefits of Depositing Checks

Depositing checks is an important way to manage your finances. It allows you to keep track of your income and expenses, and it can help you avoid overdraft fees. Additionally, depositing checks can help you earn interest on your money.

Historical Context of Deposited Checks

The practice of depositing checks has been around for centuries. The first checks were written in the 17th century, and they were used to transfer money between merchants. Over time, checks became more widely used, and they eventually became the primary way to make payments.

Conclusion

Depositing checks is an essential part of managing your finances. It is a safe and convenient way to keep track of your money and avoid overdraft fees. Additionally, depositing checks can help you earn interest on your money.

Deposited Check

A deposited check is a check that has been placed into a bank account. This can be done in person at a bank branch, through an ATM, or by using a mobile banking app. Once a check is deposited, the funds from the check will be added to the account balance.

- Convenience: Depositing checks can be done in person, through an ATM, or using a mobile banking app.

- Security: Deposited checks are safer than carrying around cash.

- Tracking: Depositing checks can help you keep track of your income and expenses.

- Interest: Deposited checks can earn interest, which can help you grow your money.

- Avoid Fees: Depositing checks can help you avoid overdraft fees.

- Peace of Mind: Knowing that your check has been deposited and the funds are in your account can give you peace of mind.

- Efficiency: Depositing checks can be a quick and easy way to add money to your account.

- Accessibility: Deposited checks can be accessed through a variety of channels, including online banking, mobile banking, and ATMs.

These key aspects highlight the importance of deposited checks in managing your finances. By depositing checks, you can keep track of your money, avoid fees, and earn interest. Additionally, deposited checks are a safe and convenient way to add money to your account.

1. Convenience

The convenience of depositing checks is a key factor in its widespread adoption. The ability to deposit checks through multiple channels provides users with flexibility and ease in managing their finances.

- In-Person Deposits:

In-person deposits offer the traditional method of depositing checks at a bank branch. This option is available during regular banking hours and provides the opportunity for face-to-face interaction with a bank teller. This can be beneficial for individuals who prefer personal assistance or need immediate access to funds. - ATM Deposits:

Automated Teller Machines (ATMs) offer a convenient and accessible way to deposit checks outside of banking hours. ATMs are widely available in various locations, including retail stores, gas stations, and bank branches. ATM deposits are usually processed quickly, providing users with prompt access to funds. - Mobile Banking Deposits:

Mobile banking apps allow users to deposit checks remotely using their smartphones. This method provides the ultimate convenience, as it can be done anytime, anywhere. Mobile banking deposits are processed electronically, offering faster access to funds compared to traditional methods. Additionally, mobile banking apps often have features that allow users to track the status of their deposits and view account balances in real-time.

The convenience of depositing checks through various channels empowers users to manage their finances efficiently and effectively. It eliminates the need to visit a bank branch during specific hours and provides flexibility in accessing funds. This convenience is a major advantage of deposited checks, contributing to its popularity and widespread use.

2. Security

Deposited checks offer enhanced security compared to carrying physical cash. By depositing a check, you transfer the responsibility of safeguarding the funds to the bank. Checks typically include security features, such as watermarks, security threads, and magnetic ink character recognition (MICR), making them difficult to counterfeit or alter.

Carrying large amounts of cash can be risky and inconvenient. It increases the chances of theft, loss, or damage. Deposited checks eliminate these risks, providing peace of mind and reducing the potential for financial loss.

In the event of a lost or stolen check, banks have established procedures to minimize the risk of unauthorized access to funds. By promptly reporting the incident to the bank, you can initiate a stop payment request, preventing the check from being cashed. This level of protection is not available when carrying cash.

Furthermore, deposited checks provide a record of transactions. Bank statements and online banking platforms offer detailed information on deposited checks, including the check number, amount, date, and payee. This documentation serves as valuable evidence for accounting and auditing purposes.

In conclusion, the security aspect of deposited checks is a significant advantage over carrying cash. The reduced risk of theft, loss, or fraud, combined with the convenience of electronic record-keeping, makes deposited checks a safer and more practical option for managing finances.

3. Tracking

Depositing checks plays a crucial role in tracking income and expenses effectively. It provides a systematic and organized approach to managing your finances, offering several key advantages:

- Accurate Record-Keeping: When you deposit a check, the transaction is recorded in your bank account statement. This creates a permanent record of the income or expense, including the date, amount, and payee. This accurate record-keeping simplifies the process of tracking your financial activities and identifying any discrepancies.

- Categorization and Budgeting: Deposited checks allow you to categorize your income and expenses into specific categories, such as salary, rent, or groceries. This categorization is essential for budgeting purposes, as it helps you understand where your money is coming from and where it is going. By tracking your expenses, you can identify areas where you may be overspending and make necessary adjustments to your budget.

- Expense Monitoring: Depositing checks provides a clear overview of your expenses. You can track recurring expenses, such as monthly bills or subscriptions, and monitor your spending patterns over time. This information empowers you to make informed decisions about your financial habits and identify potential savings opportunities.

- Tax Preparation: Deposited checks serve as valuable documentation for tax preparation. Bank statements and online banking platforms provide detailed records of your income and expenses, which can be easily accessed and organized for tax purposes. This simplifies the process of gathering the necessary information for accurate tax filing.

In conclusion, depositing checks is a fundamental aspect of tracking your income and expenses effectively. It offers a secure and organized method of recording financial transactions, enabling you to categorize and monitor your spending, prepare for tax season, and gain a comprehensive understanding of your financial situation.

4. Interest

The ability of deposited checks to earn interest is a significant advantage that contributes to the overall value of deposited checks. Interest is a payment made by a bank or other financial institution to depositors for the use of their money. When you deposit a check, the funds become part of the bank's reserves, which are used to make loans to other customers. In return for using your money, the bank pays you interest.The interest rate on deposited checks varies depending on the type of account and the financial institution. However, even a small amount of interest can add up over time, helping you to grow your money. For example, if you deposit $1,000 into an account with a 1% annual interest rate, you will earn $10 in interest after one year. This may not seem like much, but if you continue to deposit checks and earn interest over time, the amount of interest you earn can grow significantly.Earning interest on deposited checks is a simple and effective way to grow your money. It is a passive form of income that requires no effort on your part. Simply by depositing checks into your account, you can earn interest and watch your money grow.

In conclusion, the interest-earning potential of deposited checks is a valuable benefit that can contribute to your financial well-being. By taking advantage of this feature, you can grow your money over time and achieve your financial goals faster.

5. Avoid Fees

Depositing checks plays a crucial role in avoiding overdraft fees, which are charges imposed by banks when an account balance falls below a certain amount. Overdraft fees can be substantial and can quickly add up, putting a strain on your finances. Depositing checks can help you avoid these fees by ensuring that you have sufficient funds in your account to cover your transactions.

- Real-Time Updates: When you deposit a check, the funds are typically reflected in your account balance immediately. This real-time update allows you to track your balance more accurately and make informed decisions about your spending. By knowing exactly how much money you have available, you can avoid making purchases that could overdraw your account and trigger overdraft fees.

- Buffer for Pending Transactions: Deposited checks provide a buffer for pending transactions, such as debit card purchases or automatic bill payments. These transactions can take several days to clear, and if your account balance is insufficient at the time of processing, you may incur overdraft fees. Depositing checks ensures that you have enough funds to cover these pending transactions, reducing the risk of overdrafts.

- Grace Period: Some banks offer a grace period before charging overdraft fees. This grace period typically lasts for a few days and allows you to deposit funds to cover an overdraft. Depositing a check during this grace period can prevent the bank from charging you an overdraft fee.

- Avoid Recurring Fees: Overdraft fees can become a recurring problem if you frequently overdraw your account. By depositing checks regularly, you can maintain a positive account balance and avoid the cycle of overdraft fees.

In conclusion, depositing checks is an effective way to avoid overdraft fees. By ensuring that you have sufficient funds in your account, you can reduce the risk of overdrawing and protect yourself from unnecessary charges. Depositing checks regularly and tracking your account balance can help you manage your finances more effectively and avoid the financial burden of overdraft fees.

6. Peace of Mind

Depositing a check and knowing that the funds are safely in your account can provide a significant sense of peace of mind. This peace of mind stems from several key factors:

- Financial Security: A deposited check represents a secure and reliable way to receive funds. Once the check is deposited, the funds are protected by the bank's security measures, reducing the risk of loss or theft compared to carrying cash.

- Confirmation of Receipt: Depositing a check provides confirmation that the funds have been received and credited to your account. This eliminates the uncertainty associated with sending or receiving checks through the mail or other methods, where there is a risk of the check being lost or delayed.

- Access to Funds: Knowing that the funds from a deposited check are available in your account gives you peace of mind, as you can access the money whenever you need it. This eliminates the worry of having to wait for the check to clear or dealing with potential delays in receiving the funds.

In summary, the peace of mind associated with deposited checks stems from the financial security, confirmation of receipt, and access to funds that they provide. This peace of mind is an important component of the overall value of deposited checks, as it reduces financial stress and provides a sense of control over your finances.

7. Efficiency

The efficiency of depositing checks is a significant advantage that contributes to the overall value of deposited checks. Depositing checks offers several key benefits that make it a quick and easy way to add money to your account:

- Convenience: Depositing checks can be done in person at a bank branch, through an ATM, or using a mobile banking app. This flexibility allows you to deposit checks at your convenience, without having to go out of your way or wait in long lines.

- Speed: The process of depositing checks has become increasingly faster over the years. With mobile banking apps, you can deposit checks remotely and have the funds available in your account within minutes. This eliminates the need to wait for the check to clear, which can take several days.

- Ease of Use: Depositing checks is a straightforward process that requires minimal effort. The steps involved are simple and easy to follow, making it accessible to individuals of all ages and technical abilities.

In conclusion, the efficiency of depositing checks is a key aspect of its value proposition. The convenience, speed, and ease of use associated with depositing checks make it a quick and easy way to add money to your account, contributing to its popularity and widespread adoption.

8. Accessibility

The accessibility of deposited checks plays a vital role in the overall convenience and value of deposited checks. The ability to access deposited checks through multiple channels provides users with flexibility and ease in managing their finances.

- Online Banking:

Online banking allows users to access their deposited checks remotely, anytime and anywhere. With a secure internet connection, users can log in to their bank's website or mobile app to view check images, check balances, and initiate transactions. - Mobile Banking:

Mobile banking apps offer the ultimate convenience for accessing deposited checks. Users can use their smartphones to deposit checks, view check images, and manage their accounts on the go. Mobile banking apps are particularly useful for individuals who are always on the move or who prefer to bank from the comfort of their own homes. - ATMs:

Automated Teller Machines (ATMs) provide another convenient channel for accessing deposited checks. ATMs allow users to deposit checks, withdraw cash, and check their account balances. ATMs are widely available in various locations, including bank branches, retail stores, and gas stations.

The accessibility of deposited checks through multiple channels empowers users to manage their finances efficiently and effectively. It eliminates the need to visit a bank branch during specific hours and provides flexibility in accessing funds. This accessibility is a major advantage of deposited checks, contributing to its popularity and widespread use.

Frequently Asked Questions about Deposited Checks

Here are answers to some of the most common questions about deposited checks:

Question 1: How long does it take for a deposited check to clear?The time it takes for a deposited check to clear can vary depending on the bank and the type of check. Generally, personal checks take 2-3 business days to clear, while cashier's checks and certified checks typically clear within one business day.

Question 2: Can I deposit a check from my phone?Yes, many banks offer mobile banking apps that allow you to deposit checks remotely using your smartphone. Simply take a picture of the front and back of the check and submit it through the app.

Question 3: What happens if a deposited check bounces?If a deposited check bounces, the bank may reverse the transaction and deduct the amount of the check from your account. You may also be charged a fee for the bounced check.

Question 4: How can I avoid check fraud?To avoid check fraud, be cautious of accepting checks from unfamiliar sources. Examine checks carefully for any signs of alteration or forgery. Consider using electronic payment methods, such as direct deposit or online bill pay, whenever possible.

Question 5: What should I do if my deposited check is lost or stolen?If your deposited check is lost or stolen, contact your bank immediately. They can cancel the check and issue a new one. You may also want to file a police report.

These are just a few of the most common questions about deposited checks. If you have any other questions, please contact your bank.

Deposited checks are a convenient and secure way to receive and manage funds. By understanding the process and taking precautions against fraud, you can use deposited checks with confidence.

Transition to the next article section:

Conclusion

In conclusion, deposited checks are a valuable financial tool that offers numerous benefits. They provide convenience, security, the ability to track income and expenses, the potential to earn interest, protection against overdraft fees, peace of mind, efficiency, and accessibility. By understanding the process of depositing checks and taking precautions against fraud, individuals can effectively manage their finances and reap the full benefits of deposited checks.

Deposited checks have revolutionized the way we receive and manage funds. They have made it easier, safer, and more convenient to handle financial transactions. As technology continues to advance, we can expect even more innovative and efficient ways to deposit checks in the future.

Overall, deposited checks remain a cornerstone of modern banking and financial management. Their versatility and reliability make them an essential tool for individuals and businesses alike. By leveraging the advantages of deposited checks, we can optimize our financial well-being and achieve our financial goals.

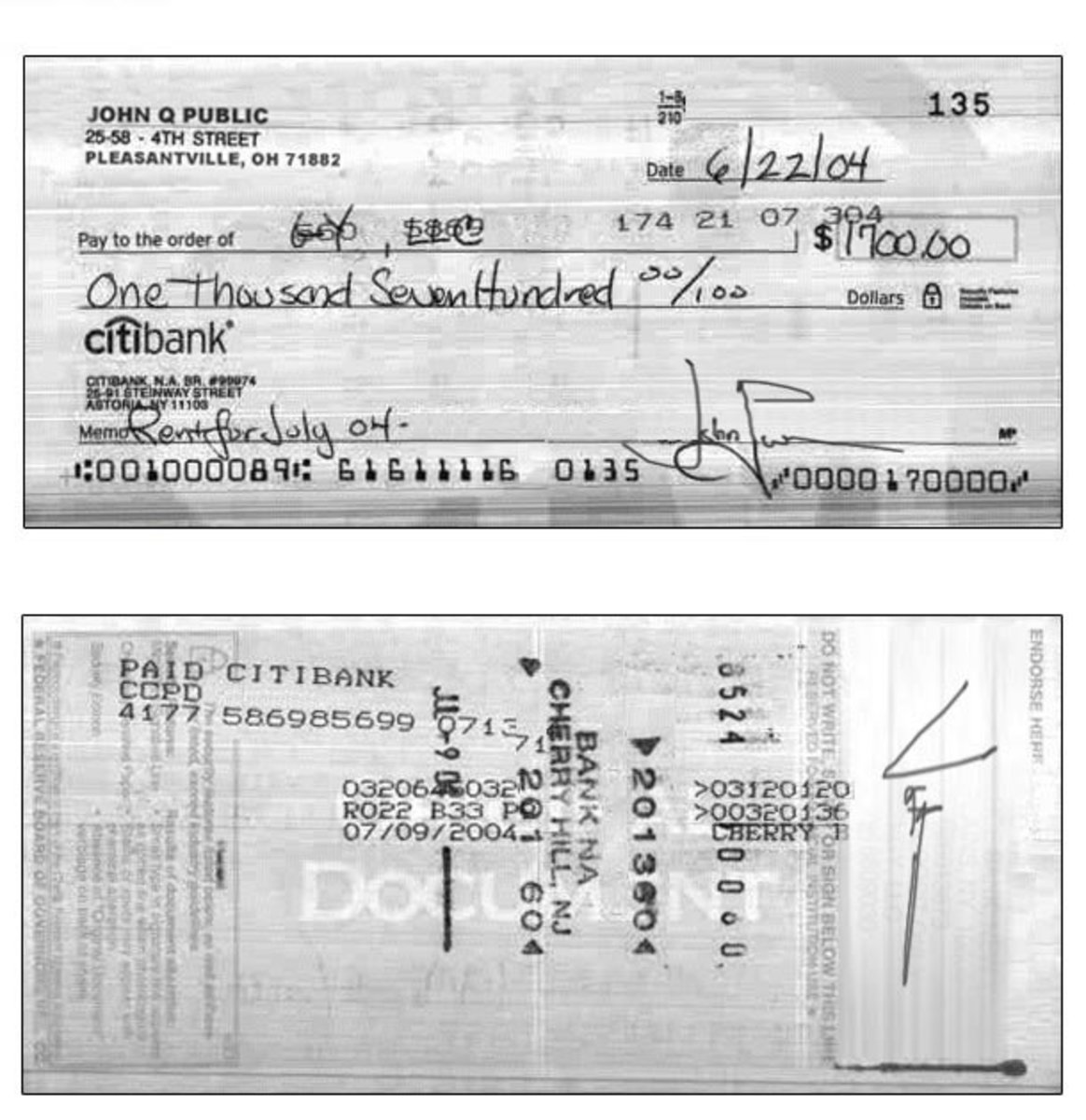

![Show a deposited check image on [SOLVED] J.D. Hodges](http://www.jdhodges.com/wp-content/uploads/2015/04/2015-04-01-08_23_18-Chase-Online-Deposit-Details-show-check-image-713x550.png)