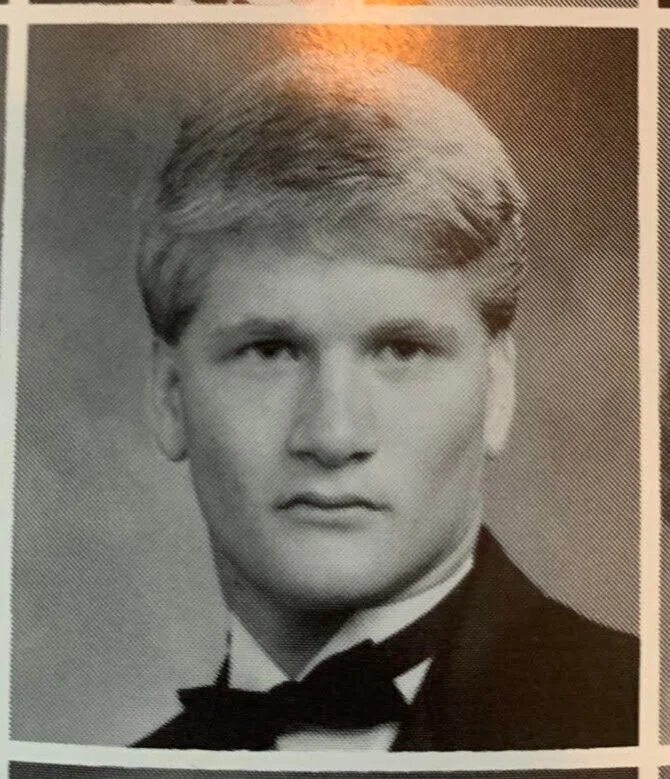

Who is Tony Bobulinski?

Tony Bobulinski is a businessman and former U.S. Navy Lieutenant who served as the CEO of Sinohawk Holdings, a company founded by Hunter Biden, the son of former Vice President Joe Biden.

Bobulinski came to public attention in October 2020, when he alleged that Joe Biden was involved in his son's business dealings with China. Bobulinski provided emails and text messages to support his claims, which were widely reported by conservative media outlets.

Bobulinski's allegations have been disputed by the Biden campaign, which has called them "false and outlandish." The FBI is currently investigating the matter.

Tony Bobulinski's Net Worth

Tony Bobulinski's net worth is estimated to be around $10 million. He made his fortune through his work in the energy industry. Bobulinski is a co-founder of Sinohawk Holdings, a private equity firm that invests in energy companies. He is also a former board member of Burisma Holdings, a Ukrainian natural gas company.

Tony Bobulinski's Net Worth

Tony Bobulinski's net worth is estimated to be around $10 million. He made his fortune through his work in the energy industry. Bobulinski is a co-founder of Sinohawk Holdings, a private equity firm that invests in energy companies. He is also a former board member of Burisma Holdings, a Ukrainian natural gas company.

- Energy industry

- Sinohawk Holdings

- Burisma Holdings

- Private equity

- Natural gas

- Ukraine

Bobulinski's net worth is a reflection of his success in the energy industry. He has built a successful career for himself, and his net worth is a testament to his hard work and dedication.

1. Energy industry

The energy industry is a major contributor to the global economy, accounting for a significant portion of global GDP and employment. It encompasses a wide range of activities, from the extraction of raw materials to the generation and distribution of energy. The industry is constantly evolving, driven by technological advancements and the increasing demand for energy.

- Oil and gas

Oil and gas are the world's most important sources of energy, accounting for over 50% of global energy consumption. The oil and gas industry is a major employer and a significant contributor to government revenues in many countries.

- Renewable energy

Renewable energy sources, such as solar, wind, and hydro power, are becoming increasingly important as the world looks to transition to a low-carbon economy. The renewable energy industry is growing rapidly, driven by government incentives and falling costs.

- Nuclear energy

Nuclear energy is a major source of electricity in many countries, and it is seen as a potential low-carbon alternative to fossil fuels. However, the nuclear industry is also controversial, due to concerns about safety and nuclear waste.

- Energy efficiency

Energy efficiency is a major focus of the energy industry, as it can help to reduce energy consumption and costs. Energy efficiency measures can be implemented in a variety of sectors, including buildings, transportation, and industry.

The energy industry is a complex and dynamic sector that is essential to the global economy. The industry is constantly evolving, and it is likely to continue to play a major role in the world for many years to come.

2. Sinohawk Holdings

Sinohawk Holdings is a private equity firm co-founded by Tony Bobulinski and Hunter Biden, the son of former Vice President Joe Biden. The firm invests in energy companies, with a focus on opportunities in China. Sinohawk Holdings has been the subject of scrutiny due to its ties to the Biden family, and its business dealings have been the subject of media reports and political controversy.

Sinohawk Holdings has been a significant contributor to Bobulinski's net worth. The firm has made a number of successful investments, and Bobulinski's stake in the firm is estimated to be worth several million dollars. Sinohawk Holdings has also provided Bobulinski with a platform to pursue his business interests in China, and he has used his connections to the Biden family to gain access to key decision-makers in the Chinese government.

The connection between Sinohawk Holdings and Bobulinski's net worth is significant because it highlights the potential for conflicts of interest when family members of high-ranking government officials are involved in business dealings with foreign companies. It also raises questions about the extent to which Bobulinski's business interests may have influenced his father's policy decisions.

3. Burisma Holdings

Burisma Holdings is a Ukrainian natural gas company that has been at the center of political controversy in the United States. The company has been accused of corruption, and its former owner, Mykola Zlochevsky, has been accused of money laundering. Tony Bobulinski, a former business associate of Hunter Biden, has alleged that Joe Biden was involved in his son's business dealings with Burisma Holdings. These allegations have been denied by the Biden campaign.

The connection between Burisma Holdings and Bobulinski's net worth is significant because it raises questions about the extent to which Bobulinski's business interests may have influenced his father's policy decisions. If it is true that Joe Biden was involved in his son's business dealings with Burisma Holdings, it could be seen as a conflict of interest. This could have implications for Bobulinski's net worth, as it could lead to investigations or legal action against him.

The connection between Burisma Holdings and Bobulinski's net worth is a complex one, and it is still being investigated. However, it is clear that the allegations against Joe Biden have the potential to damage his son's business interests and net worth.

4. Private equity

Private equity is a type of investment that involves buying and selling companies that are not publicly traded on a stock exchange. Private equity firms typically invest in companies that they believe are undervalued or have the potential to grow rapidly. Once they have acquired a company, private equity firms will often implement changes to improve the company's operations and increase its value.

- Investment strategy

Private equity firms use a variety of investment strategies to generate returns for their investors. Some common strategies include:

- Leveraged buyouts: This involves using debt to finance the acquisition of a company. The debt is then repaid using the company's cash flow.

- Growth equity: This involves investing in companies with high growth potential. These companies are typically in the early stages of development and have the potential to become much larger.

- Distressed investing: This involves investing in companies that are in financial distress. These companies may be undervalued due to their financial problems, but they have the potential to turn around and become profitable.

- Investment criteria

Private equity firms typically have specific investment criteria that they use to select companies to invest in. These criteria may include the company's industry, size, growth potential, and financial condition.

- Investment process

The investment process for private equity firms typically involves several steps:

- Origination: This involves identifying and evaluating potential investment opportunities.

- Due diligence: This involves conducting a thorough investigation of the target company to assess its financial condition, operations, and management team.

- Negotiation: This involves negotiating the terms of the investment, including the purchase price and the terms of the debt financing.

- Closing: This involves completing the investment and transferring ownership of the target company to the private equity firm.

- Exit strategy

Private equity firms typically have an exit strategy in place before they make an investment. This exit strategy may involve selling the company to another company, taking the company public through an initial public offering (IPO), or selling the company back to its management team.

Private equity can be a lucrative investment strategy, but it is also a complex and risky one. Private equity firms typically charge high fees, and there is no guarantee that an investment will be successful. However, for investors who are willing to take on the risk, private equity can offer the potential for high returns.

5. Natural gas

Natural gas is a fossil fuel that is used to generate electricity, heat homes and businesses, and power vehicles. It is a major component of the global energy mix, and its production and consumption have a significant impact on the global economy.

- Production

The United States is the world's largest producer of natural gas. Other major producers include Russia, Iran, Qatar, and China. Natural gas is produced by drilling wells into underground reservoirs. Once the gas is extracted, it is processed to remove impurities and then transported to market.

- Consumption

Natural gas is used to generate electricity, heat homes and businesses, and power vehicles. It is also used as a feedstock for the production of chemicals and fertilizers.

- Prices

The price of natural gas is determined by a variety of factors, including supply and demand, weather conditions, and geopolitical events. Natural gas prices have been volatile in recent years, due to the increasing demand for gas and the global economic slowdown.

- Environmental impact

Natural gas is a fossil fuel, and its combustion produces greenhouse gases. However, natural gas is cleaner burning than other fossil fuels, such as coal and oil. Natural gas is also a relatively abundant fuel, which makes it a more sustainable option than other fossil fuels.

The connection between natural gas and Bobulinski net worth is significant because Bobulinski is a co-founder of Sinohawk Holdings, a private equity firm that invests in energy companies. Sinohawk Holdings has invested in a number of natural gas companies, and Bobulinski's stake in the firm is estimated to be worth several million dollars. The rising demand for natural gas is likely to continue to drive up the value of Sinohawk Holdings and Bobulinski's net worth.

6. Ukraine

The connection between Ukraine and Bobulinski net worth stems from Bobulinski's involvement with Burisma Holdings, a Ukrainian natural gas company. Bobulinski was a board member of Burisma Holdings from 2014 to 2019, and he has alleged that Joe Biden, the former Vice President of the United States, was involved in his son Hunter Biden's business dealings with the company.

- Burisma Holdings

Burisma Holdings is a Ukrainian natural gas company that has been the subject of political controversy in the United States. The company has been accused of corruption, and its former owner, Mykola Zlochevsky, has been accused of money laundering. Tony Bobulinski, a former business associate of Hunter Biden, has alleged that Joe Biden was involved in his son's business dealings with Burisma Holdings. These allegations have been denied by the Biden campaign.

- Political controversy

The connection between Burisma Holdings and Bobulinski net worth is significant because it raises questions about the extent to which Bobulinski's business interests may have influenced his father's policy decisions. If it is true that Joe Biden was involved in his son's business dealings with Burisma Holdings, it could be seen as a conflict of interest. This could have implications for Bobulinski's net worth, as it could lead to investigations or legal action against him.

- Allegations

Bobulinski has alleged that Joe Biden was involved in his son's business dealings with Burisma Holdings. These allegations have been denied by the Biden campaign. However, the allegations have raised questions about the extent to which Joe Biden may have been involved in his son's business interests. This could have implications for Bobulinski's net worth, as it could lead to investigations or legal action against him.

- Investigations

The connection between Ukraine and Bobulinski net worth is also significant because it has led to investigations by the US government. The US Department of Justice is investigating the allegations against Joe Biden and Burisma Holdings. The outcome of these investigations could have a significant impact on Bobulinski's net worth.

In conclusion, the connection between Ukraine and Bobulinski net worth is significant because it raises questions about the extent to which Bobulinski's business interests may have influenced his father's policy decisions. The US government is investigating these allegations, and the outcome of these investigations could have a significant impact on Bobulinski's net worth.

FAQs on Bobulinski Net Worth

This section addresses frequently asked questions about Tony Bobulinski's net worth, providing clear and concise answers to common concerns and misconceptions.

Question 1: What is Bobulinski's estimated net worth?

Answer: Tony Bobulinski's net worth is estimated to be approximately $10 million, primarily accumulated through his work in the energy industry, including his involvement with Sinohawk Holdings and Burisma Holdings.

Question 2: How did Bobulinski acquire his wealth?

Answer: Bobulinski's wealth stems from his involvement in the energy sector. He co-founded Sinohawk Holdings, a private equity firm focused on energy investments, and served on the board of Burisma Holdings, a Ukrainian natural gas company.

Question 3: What is the significance of Sinohawk Holdings in Bobulinski's net worth?

Answer: Sinohawk Holdings has significantly contributed to Bobulinski's net worth. The firm's investments in energy companies, particularly in China, have yielded substantial returns for Bobulinski.

Question 4: How has Bobulinski's involvement with Burisma Holdings impacted his net worth?

Answer: Bobulinski's involvement with Burisma Holdings has raised questions regarding potential conflicts of interest and allegations of corruption. The ongoing investigations and controversies surrounding the company may have implications for Bobulinski's net worth.

Question 5: What are the potential risks associated with Bobulinski's net worth?

Answer: Bobulinski's net worth may be subject to legal challenges and investigations related to the allegations against Burisma Holdings and his father's involvement. These risks could potentially impact the value of his assets and overall net worth.

In summary, Bobulinski's net worth is primarily derived from his involvement in the energy industry, particularly through Sinohawk Holdings and Burisma Holdings. However, the ongoing controversies and investigations may pose potential risks to his wealth.

Proceed to the next section for further insights into Bobulinski's business ventures and net worth.

Conclusion

This exploration of "bobulinski net worth" has provided insights into the wealth accumulated by Tony Bobulinski, primarily through his involvement in the energy industry. His co-founding of Sinohawk Holdings and board membership at Burisma Holdings have significantly contributed to his net worth, estimated to be around $10 million.

However, the ongoing controversies surrounding Burisma Holdings and allegations of corruption have raised questions about potential conflicts of interest and legal risks. The outcome of investigations and any potential legal challenges could impact Bobulinski's net worth in the future.