What is a Branch Number for a Bank?

A branch number is a unique identifier assigned to each physical location of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place. The branch number is typically included on checks, deposit slips, and other banking documents.

Branch numbers are important for a number of reasons. They help banks to process transactions efficiently and accurately. They also allow customers to easily identify the branch where they can conduct their banking business.

In the United States, branch numbers are typically five digits long. The first two digits identify the state where the branch is located, and the remaining three digits identify the specific branch within that state.

Branch numbers are an essential part of the banking system. They help to ensure that transactions are processed quickly and accurately, and they provide customers with a convenient way to identify the branch where they can conduct their banking business.

What is a Branch Number for a Bank

A branch number is a unique identifier assigned to each physical location of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place. Branch numbers are typically included on checks, deposit slips, and other banking documents.

- Unique identifier

- Physical location

- Account identification

- Transaction processing

- Customer convenience

- Efficient banking

Branch numbers are an essential part of the banking system. They help to ensure that transactions are processed quickly and accurately, and they provide customers with a convenient way to identify the branch where they can conduct their banking business.

For example, when you write a check, you will need to include the branch number of the bank where your account is held. This helps the bank to process the check and ensure that the funds are transferred to the correct account.

Branch numbers are also used to identify the specific branch where you can conduct transactions in person. For example, if you need to deposit cash or withdraw money, you will need to visit the branch that is associated with your account number.

Overall, branch numbers play an important role in the banking system. They help to ensure that transactions are processed quickly and accurately, and they provide customers with a convenient way to identify the branch where they can conduct their banking business.1. Unique identifier

A branch number is a unique identifier assigned to each physical location of a bank. It is used to identify the specific branch where an account is held or a transaction is taking place. Branch numbers are typically included on checks, deposit slips, and other banking documents.

- Role of branch numbers as unique identifiers: Branch numbers play a crucial role in identifying specific bank branches within a bank's network. They serve as unique codes that differentiate one branch from another, enabling efficient routing of transactions and communication.

- Examples of branch numbers: Branch numbers are typically composed of a combination of numbers and/or letters. For instance, a branch number could be "12345" or "ABC123". Each branch is assigned its own unique branch number, ensuring its distinction from other branches.

- Implications for banking operations: The unique identification provided by branch numbers is essential for various banking operations. It allows banks to accurately process transactions, such as deposits, withdrawals, and transfers, by directing them to the correct branch. Additionally, branch numbers facilitate communication between different branches, enabling seamless coordination and information sharing.

In summary, the unique identifier aspect of branch numbers is fundamental to the efficient functioning of banking systems. By providing a distinct identity to each branch, branch numbers streamline banking operations, enhance communication, and ensure the smooth flow of transactions within a bank's network.

2. Physical location

A branch number is closely connected to the physical location of a bank branch. It serves as a unique identifier for each branch, allowing for efficient routing of transactions and communication within a bank's network.

The physical location of a bank branch is important for several reasons. First, it provides a physical presence for the bank in the community. This allows customers to easily access banking services, such as deposits, withdrawals, and loan applications.

Second, the physical location of a bank branch can impact the types of services that are offered. For example, a branch located in a business district may offer more commercial banking services, while a branch located in a residential area may offer more personal banking services.

Finally, the physical location of a bank branch can affect the convenience for customers. Customers want to be able to access their bank branch easily and quickly. A branch that is located in a convenient location will be more likely to attract and retain customers.

Overall, the physical location of a bank branch is an important factor to consider when choosing a bank. Customers should choose a bank branch that is convenient for them and that offers the services they need.

3. Account identification

A branch number is closely connected to account identification within the banking system. It plays a crucial role in ensuring that financial transactions are processed accurately and efficiently, reaching the intended recipient's account.

When a customer opens an account at a bank, they are assigned a unique account number. This account number is used to identify the customer's account and track their financial transactions. However, account numbers alone are not sufficient to ensure that transactions are processed correctly.

This is where branch numbers come into play. Each bank branch is assigned a unique branch number. When a customer makes a deposit or withdrawal, the branch number is used to identify the specific branch where the transaction took place. This information is then used to ensure that the transaction is processed correctly and posted to the customer's account.

For example, consider a customer who deposits a check into their account at a local branch. The branch number associated with that branch is included on the check. When the check is processed, the branch number is used to identify the branch where the deposit was made. This information is then used to update the customer's account balance and ensure that the funds are available to them.

Without branch numbers, it would be much more difficult to process banking transactions accurately and efficiently. Branch numbers provide an essential layer of identification that helps to ensure that transactions are processed correctly and posted to the correct accounts.

4. Transaction processing

Transaction processing is a critical aspect of banking operations, and branch numbers play a vital role in ensuring its efficiency and accuracy. Let's explore the connection between "Transaction processing" and "what is a branch number for a bank":

- Identification of branch location: Branch numbers serve as unique identifiers for each physical branch of a bank. When a transaction is initiated, the branch number associated with the account or the branch where the transaction is taking place is used to identify the specific location involved.

- Routing of transactions: Branch numbers facilitate the routing of transactions within a bank's network. Based on the branch number provided, the transaction is directed to the appropriate branch for processing, ensuring it reaches the intended destination.

- Account validation: Branch numbers help validate account information during transaction processing. By matching the branch number provided by the customer with the branch number associated with their account, banks can verify the authenticity and legitimacy of the transaction.

- Fraud prevention: Branch numbers can assist in fraud prevention efforts. Unusual transactions or attempts to access accounts from unfamiliar branches can raise red flags, prompting banks to investigate and take appropriate action.

In summary, transaction processing relies heavily on branch numbers to ensure the smooth flow of financial transactions within a bank. Branch numbers provide a secure and efficient mechanism for identifying branch locations, routing transactions, validating account information, and preventing fraudulent activities.

5. Customer convenience

Customer convenience is a crucial aspect of banking, and branch numbers play a significant role in enhancing it. When customers have easy access to banking services, they are more likely to be satisfied with their bank and continue doing business with them.

Branch numbers contribute to customer convenience in several ways:

- Identification of nearby branches: Branch numbers allow customers to easily identify the physical location of bank branches. By providing the branch number, customers can use online locators or mobile apps to find the nearest branch, making it convenient for them to conduct their banking business.

- Simplified transactions: Branch numbers streamline transactions by ensuring that customers are directed to the correct branch for their needs. When a customer provides their branch number, bank tellers and customer service representatives can quickly access their account information and assist them with their transactions.

- Reduced wait times: Branch numbers help reduce wait times by distributing customer traffic across different branches. By providing multiple branch locations, customers have the flexibility to choose the branch that is most convenient for them, reducing congestion and wait times.

In summary, branch numbers are essential for customer convenience in banking. They provide easy access to banking services, simplify transactions, and reduce wait times, ultimately enhancing the overall customer experience.

6. Efficient banking

Efficient banking is a crucial aspect of modern financial systems, and branch numbers play a significant role in achieving it. Branch numbers contribute to efficient banking in several ways:

- Optimized resource allocation: Branch numbers enable banks to optimize their resource allocation by distributing customer traffic across different branches. By understanding the transaction patterns and customer preferences associated with each branch, banks can ensure that resources, such as staff and infrastructure, are allocated efficiently to meet customer demand.

- Improved transaction processing: Branch numbers facilitate efficient transaction processing by providing a clear and standardized way to identify the branch where a transaction originated or needs to be processed. This allows banks to automate many transaction-related tasks, reducing processing times and improving overall efficiency.

- Reduced operational costs: By streamlining transaction processing and optimizing resource allocation, branch numbers help banks reduce their operational costs. This efficiency translates into lower banking fees and better interest rates for customers.

In summary, branch numbers are essential for efficient banking. They enable banks to allocate resources effectively, improve transaction processing, and reduce operational costs, ultimately benefiting both banks and their customers.

FAQs

This section aims to address frequently asked questions (FAQs) about branch numbers for banks, providing clear and informative answers.

Question 1: What exactly is a branch number?

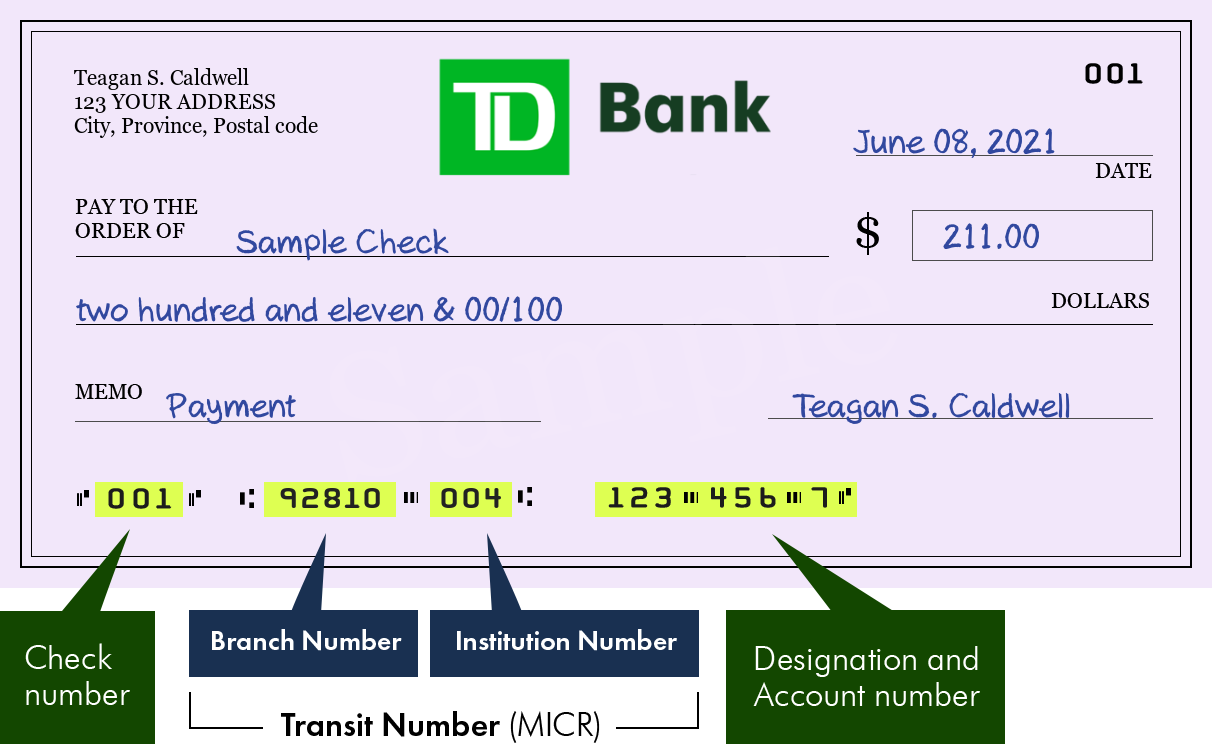

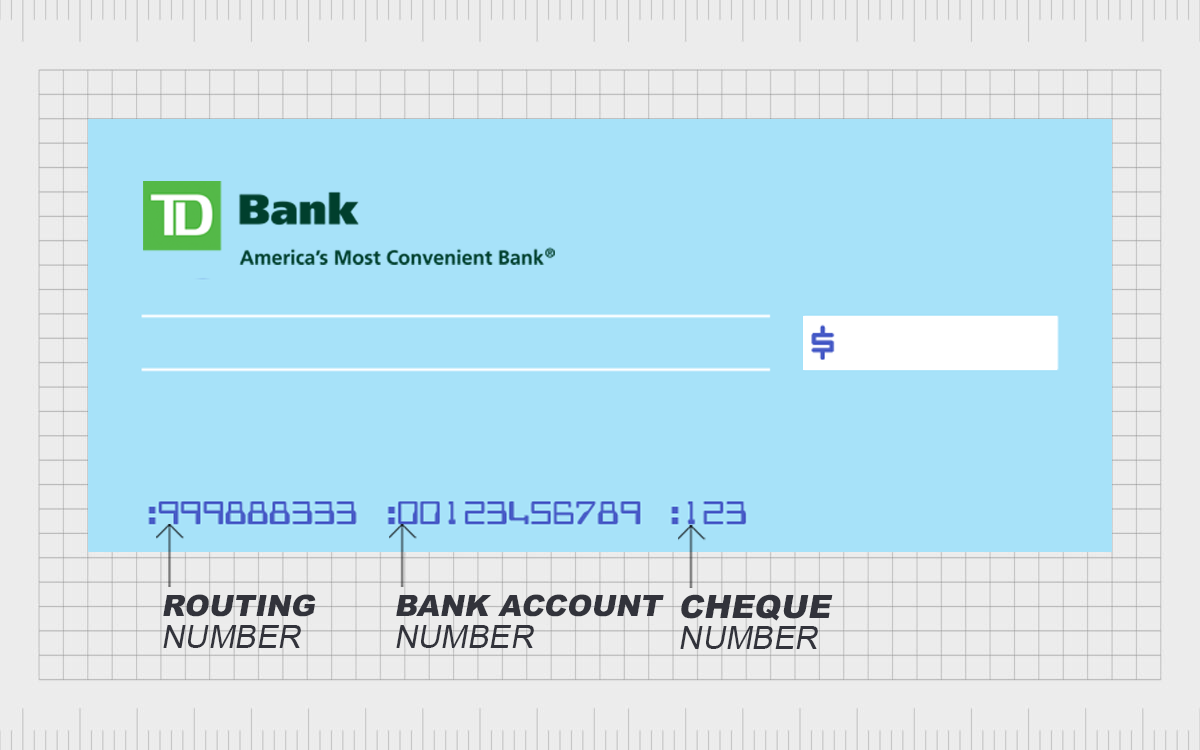

A branch number is a unique identifier assigned to each physical location of a bank. It helps identify the specific branch where an account is held or a transaction is taking place, typically appearing on checks, deposit slips, and other banking documents.

Question 2: Why are branch numbers important?

Branch numbers play a crucial role in efficient banking operations. They facilitate accurate transaction processing, customer identification, and communication within a bank's network.

Question 3: How can I find the branch number for my bank account?

You can usually find the branch number printed on your checks, deposit slips, or bank statements. Alternatively, you can contact your bank directly or check their website for the branch number associated with your account.

Question 4: What if I'm not sure which branch my account is with?

If you're unsure about the branch associated with your account, you can contact your bank's customer service or visit a nearby branch for assistance in identifying the correct branch number.

Question 5: Are branch numbers the same as routing numbers?

No, branch numbers and routing numbers are different. A branch number identifies a specific branch of a bank, while a routing number identifies the bank itself and is used for electronic fund transfers between different banks.

Summary:

Branch numbers serve as essential identifiers for bank branches, enabling efficient transaction processing, customer identification, and overall banking operations. Understanding branch numbers is important for customers to manage their accounts and conduct banking activities smoothly.

Transition:

Now that we have addressed common questions about branch numbers, let's explore their significance and benefits in more detail.

Conclusion

In conclusion, branch numbers play a vital role in the banking industry, providing a unique identification system for bank branches. They facilitate efficient transaction processing, accurate account identification, streamlined communication, and enhanced customer convenience.

Understanding branch numbers is essential for customers to manage their accounts effectively, conduct banking activities seamlessly, and navigate the banking system with ease. Banks leverage branch numbers to optimize resource allocation, improve operational efficiency, and deliver a superior customer experience.